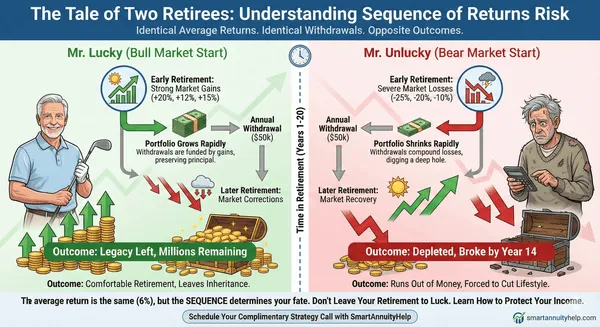

What Is Sequence of Returns Risk and Why It Hits Retirees Hardest

You have spent decades building your nest egg, likely focusing on a single number: your average annual return. But once you retire and start withdrawing income, "average" returns become meaningless. This post uncovers the hidden danger of Sequence of Returns Risk—a mathematical trap that can deplete a million-dollar portfolio in under 15 years, even in a decent market. Through the tale of "Mr. Lucky vs. Mr. Unlucky," we illustrate why the order of your investment returns matters more than the amount. Stop leaving your financial survival to luck. Learn how Fixed Index Annuities can act as a mathematical floor, protecting your principal from early market crashes while ensuring your income lasts as long as you do.