What Is Sequence of Returns Risk and Why It Hits Retirees Hardest

You have likely spent the last 30 or 40 years focused on one specific number: The Average Rate of Return.

Your financial advisor probably showed you a nice, colorful chart that says, “If the market averages 7% or 8% over the long run, you’ll have plenty of money to last until you’re 95.”

It sounds comforting. It sounds logical. But it ignores the single biggest danger facing modern retirees—a mathematical trap that can deplete a million-dollar portfolio in under 15 years, even if the "market average" stays positive.

It is called Sequence of Returns Risk, and if you are within five years of retirement, it is the most critical concept you need to understand today.

The “Average” Return Lie

During your working years (the "accumulation phase"), the order of your returns didn't matter. If the market crashed when you were 45, it was actually good news—you were buying cheaper shares with your 401(k) contributions. You had time to wait for the recovery.

But the moment you retire and start pulling money out for income (the "decumulation phase"), the rules change entirely.

Now, you don't have the luxury of time. If you experience a market downturn early in retirement while simultaneously withdrawing money to pay bills, you dig a hole that your portfolio can never climb out of.

The Tale of Two Retirees: Mr. Lucky vs. Mr. Unlucky

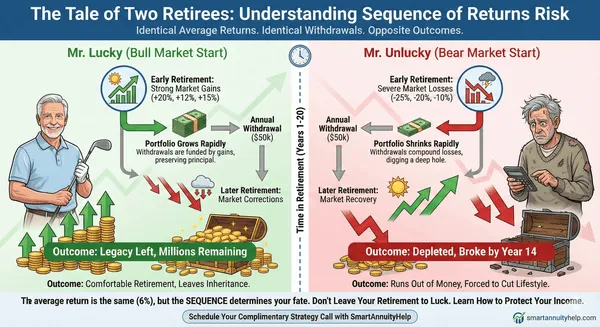

To understand why this happens, let’s look at a hypothetical example of two retirees, Mr. Lucky and Mr. Unlucky.

Both start retirement with $1,000,000. Both withdraw $50,000 a year for living expenses. Both experience the exact same average return of 6% over 20 years.

The only difference? The order in which those returns happen.

Mr. Lucky retires during a bull market. He gets three years of great growth (+20%, +12%, +15%) right out of the gate. Even when the market crashes later in his retirement, his "bucket" is so full that it doesn't matter. He ends up leaving millions to his heirs.

Mr. Unlucky retires during a bear market (like 2000 or 2008). He loses -15% in Year 1 and -10% in Year 2. Because he is also withdrawing that $50,000/year while his account is down, he is forced to sell more shares just to generate the same cash.

The Result: Despite having the same "average" return, Mr. Unlucky runs out of money completely by year 14. Mr. Lucky dies wealthy.

This is Sequence of Returns Risk. It is the luck of the draw. And if your retirement plan relies on "luck," you don't have a plan—you have a gamble.

Why Generic Financial Advice Fails Here

Most traditional financial advisors operate on the "accumulation" mindset. They will tell you to stay invested in a mix of stocks and bonds (the classic 60/40 split) and "ride out the volatility."

But when you are retired, volatility is the enemy of income.

When the market drops 20%, you need a 25% gain just to get back to even. If you are withdrawing money during that drop, you might need a 40% or 50% gain to recover. Those types of gains rarely happen fast enough to save a retiree’s lifestyle.

The Solution: A Mathematical Floor

So, how do you remove "luck" from the equation? You need an asset that protects you from the downside while allowing you to capture the upside.

This is where Fixed Index Annuities (FIAs) shine.

Unlike variable annuities (which we generally advise against because they leave your money exposed to market losses and high fees), a Fixed Index Annuity offers a contractual floor.

If the market goes up: You share in the growth up to a cap.

If the market crashes: Your return is 0%. You lose nothing. Your principal is locked in.

In the "Mr. Unlucky" scenario above, imagine if in those first two bad years, instead of losing -15% and -10%, he simply earned 0%.

That "zero" is a hero. It stops the bleeding. It ensures that when you withdraw your $50,000 income, you aren't cannibalizing your principal to do it. By removing the negative years from the sequence, you dramatically increase the probability that your money will last as long as you do.

Don't Leave Your Retirement to Chance

You cannot control what the S&P 500 does the year you retire. You cannot control inflation. You cannot control global politics.

But you can control whether your retirement income is exposed to those risks.

If you are approaching retirement and your current advisor is still talking about "average returns" without showing you a stress test for a 2008-style crash, you are vulnerable.

To learn more about how these concepts can fit in your retirement, schedule a time below.