“Will I Run Out of Money in Retirement?” The 3 Key Variables

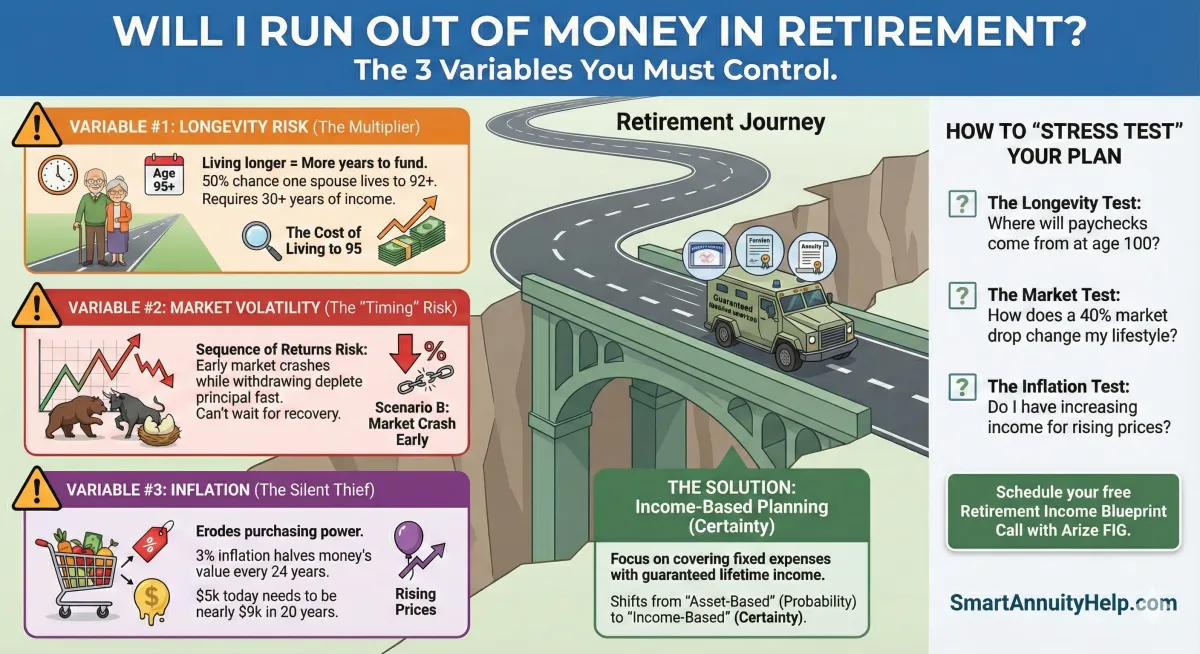

Will I Run Out of Money in Retirement? The 3 Variables You Must Control

By Moritz Loehr

There is a fear that is becoming more common than the fear of public speaking, spiders, or even death itself. It is the fear of outliving your money.

If you wake up at 3:00 AM worrying about your financial future, you are not alone. A recent study found that over 60% of baby boomers fear running out of money in retirement more than they fear passing away.

It makes sense. When you are working, you can always earn more money. If the stock market drops, you have time to wait for it to recover. But once you retire, the paychecks stop, and you have to rely on what you’ve built.

The question "Will I run out of money?" cannot be answered with a simple "Yes" or "No." It depends on how you manage three critical variables. If you ignore them, your risk rises. If you control them, you can retire with confidence.

The "Safe" Number Is a Moving Target

For years, financial "gurus" threw around magic numbers. "If you save $1 million, you’re set!" or "Just withdraw 4% a year and you’ll be fine."

But retirement isn't a static math problem; it's a dynamic life event. A $1 million portfolio in 1990 earned enough interest to live on comfortably. Today, with interest rates fluctuating and costs rising, that same million might generate significantly less safe income.

Instead of focusing on a "magic number" for your net worth, you need to focus on the variables that threaten that net worth.

Variable #1: Longevity Risk (The Multiplier)

The first variable is the one we should be happiest about, yet it causes the most financial strain: We are living longer.

You Are Likely to Live Longer Than You Think

If you look at an actuarial table, it might say the average life expectancy is around 76 or 81. But "average" includes everyone—including those with chronic illnesses or accidents.

If you are a married couple, age 65, in reasonably good health, there is a 50% chance that one of you will live to age 92, and a 25% chance one will see age 97.

The Cost of Living to 95

Living to 95 is a blessing, but it is an expensive one. It means your portfolio needs to last for a 30-year "unemployment" period. It also increases the likelihood of needing expensive healthcare or long-term care in your final years.

If your financial plan assumes you will pass away at 85, but you live to 95, those last ten years could be financially devastating for your surviving spouse.

Variable #2: Market Volatility (The "Timing" Risk)

When you are saving for retirement, volatility is annoying. When you are in retirement, volatility can be fatal to your portfolio.

This is due to a concept called Sequence of Returns Risk.

Imagine you retire with $500,000.

Scenario A: The market goes up 20% in your first two years. You withdraw your income, but the growth replaces it. Your principal stays healthy.

Scenario B: The market crashes 20% in your first two years. You still withdraw your income. Now, you are selling investments at a low price. You deplete your principal so deeply that even if the market recovers later, you have no money left to benefit from the rebound.

You cannot control the market, but you can control how exposed your essential income is to that market.

Variable #3: Inflation (The Silent Thief)

Inflation is the risk you don't see coming until you’re at the grocery store.

Historically, inflation averages around 3% per year. That sounds small, but it works like compound interest in reverse. At 3% inflation, the purchasing power of your money is cut in half every 24 years.

If you need $5,000/month to cover your bills today...

In 20 years, you may need nearly $9,000/month just to buy the same groceries and gas.

Many retirees keep too much cash in the bank because it feels "safe." But if your bank pays 1% interest and inflation is 3%, you are safely losing 2% of your purchasing power every single year.

Are your savings ready for the long haul?

You can’t predict how long you’ll live or what inflation will do next year. But you can build a plan that handles these variables.

Schedule your free Retirement Income Blueprint Masterclass today at SmartAnnuityHelp.com/book. We’ll help you "stress test" your current strategy against longevity, volatility, and inflation.

The Solution: Income-Based Planning

To answer the question "Will I run out of money?" you need to shift your mindset from Asset-Based Planning to Income-Based Planning.

The Asset-Based Approach (Probability)

This is the traditional "cross your fingers" method. You keep your money in the market and hope you earn enough returns to withdraw 4% a year without running dry. It relies on probability. It works most of the time, but "most of the time" isn't good enough when it’s your livelihood.

The Income-Based Approach (Certainty)

This approach focuses on covering your fixed expenses with guaranteed income sources (like Social Security, Pensions, and Annuities).

If your basic bills are $4,000/month, you ensure you have $4,000/month coming in from guaranteed sources.

This way, even if the market crashes or you live to 105, your lights stay on and your pantry stays full.

ow to "Stress Test" Your Retirement Plan

You wouldn't drive a car across the country without checking the brakes and the tires. You shouldn't start retirement without stress-testing your portfolio.

Ask yourself these three questions:

The Longevity Test: If I live to age 100, where will my paycheck come from in that final year?

The Market Test: If the stock market drops 40% next year, how will that change my lifestyle?

The Inflation Test: Do I have a source of income that can increase over time to keep up with rising prices?

If you don't have clear answers to these questions, your plan has cracks in the foundation.

Frequently Asked Questions

Q: How much can I safely withdraw from my portfolio? A: The old "4% Rule" is being debated. In a low-interest-rate environment, many experts suggest 2.8% to 3.5% is safer if you rely solely on stocks and bonds. Using guaranteed income products can sometimes allow for higher withdrawal rates.

Q: Does Social Security protect me from running out of money? A: Yes, Social Security is guaranteed for life. However, for most people, it only replaces about 40% of their pre-retirement income. Relying on it alone usually results in a drastic drop in lifestyle.

Q: Should I work longer to ensure I don't run out? A: Working longer helps in two ways: it gives you more time to save, and it reduces the number of years you need to fund. However, many people are forced to retire earlier than planned due to health or layoffs, which is why planning early is vital.

The Bottom Line

Will you run out of money in retirement? Not if you have a plan that respects the risks.

You cannot control the stock market. You cannot control the inflation rate. And you certainly can't control exactly how long you will live. But you can structure your retirement income so that no matter what happens with those variables, your check keeps coming.

Don't leave your future to chance.

Let’s find out if your plan is built to last. Schedule your Retirement Income Blueprint session with SmartAnnuityHelp.com/book. We will run the numbers and help you build a strategy designed to go the distance.