Sequence of Returns Risk: The Retirement Threat No One Told You About

Sequence of Returns Risk: The Retirement Threat No One Told You About

By Moritz Loehr

Imagine two neighbors, Bill and Ted.

They both retire on the same day with $500,000. They both withdraw $25,000 a year to live on. Over the next 20 years, they both experience the exact same average stock market return of 6%.

Twenty years later, Bill is broke. He has $0 left. Ted, on the other hand, has grown his account to $1.2 million.

How is this possible? If they had the same money, same withdrawals, and same average return, shouldn't they have the same result?

No. Because Bill was unlucky. He experienced his market losses early in retirement, while Ted experienced his losses later.

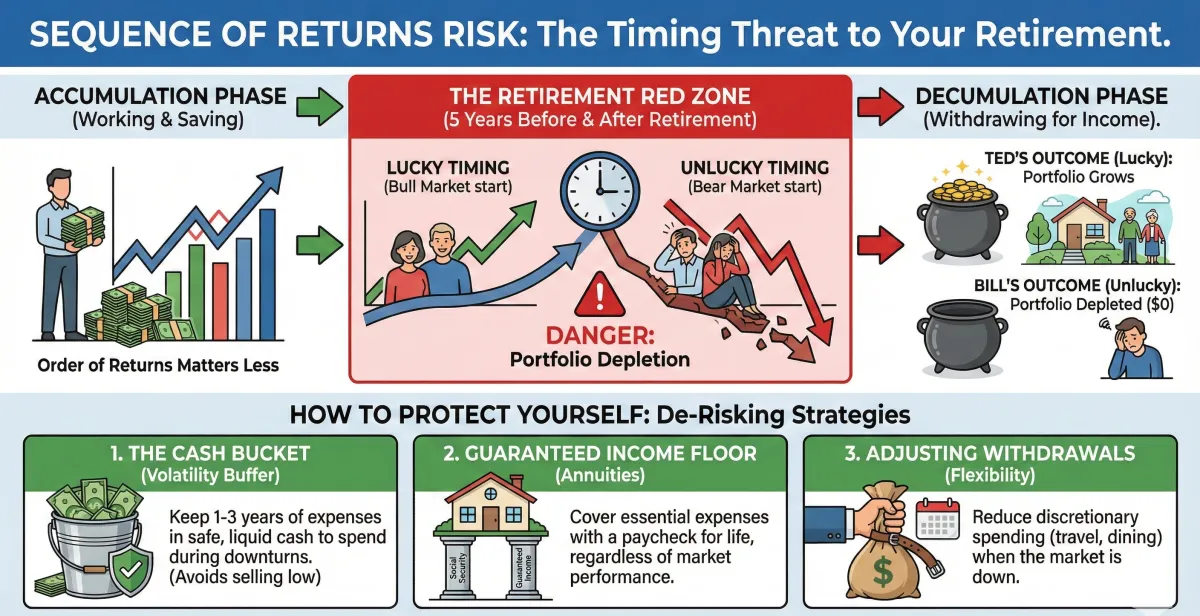

This phenomenon is called Sequence of Returns Risk, and it is the single biggest mathematical threat to your retirement portfolio.

What Is Sequence of Returns Risk?

When you are working and saving money (the "Accumulation Phase"), the order of your investment returns doesn't matter. If the market drops 20% this year and goes up 20% next year, you end up in roughly the same place. In fact, a market drop while you are saving can be good—it lets you buy more shares at a discount (Dollar Cost Averaging).

But the moment you retire and start withdrawing money (the "Decumulation Phase"), the math changes entirely.

Sequence of Returns Risk is the danger that you will experience negative market returns early in your retirement.

Think of it like walking up a "down" escalator.

If the escalator is moving slowly (a flat market), you can still make progress.

If the escalator speeds up downward (a market crash) while you are trying to climb up (withdraw income), you will be pulled to the bottom very quickly.

The Math: Why "Average" Returns Are a Lie

Financial advisors love to quote average returns. "The S&P 500 averages 8-10%!"

But you don't live on averages. You live on actual, year-to-year cash flow.

The "Death Spiral" of Withdrawing During a Crash

Let’s look at the math. Suppose you have $100,000 and you plan to withdraw $5,000 (5%).

If the market drops 20% in Year 1:

Your $100,000 drops to $80,000 due to the market.

You withdraw your $5,000.

You are left with $75,000.

Now, to get back to your original $100,000, your portfolio doesn't need to grow by 20%. It needs to grow by 33%.

Because you withdrew money while the account was down, you have fewer dollars left working for you to catch the recovery. This creates a spiral that depletes your nest egg years faster than projected.

The "Retirement Red Zone"

The most dangerous time for Sequence of Returns Risk is a window we call the Retirement Red Zone. This is typically the 5 years before you retire and the 5 years after you retire.

5 Years Before: If the market crashes just before you retire, you may have to delay your retirement date.

5 Years After: If the market crashes right after you retire (like it did in 2000-2002 or 2008), your portfolio survival rate plummets.

If you can get through the first 10 years of retirement with positive returns, your risk drops significantly. But if you get hit early, the damage can be permanent.

Are you in the Red Zone?

If you are within 5 years of retirement, or recently retired, your portfolio is at its most vulnerable point. A traditional "buy and hold" strategy may not be enough.

Schedule your free Retirement Income Blueprint Masterclass at SmartAnnuityHelp.com/book. We can show you how to structure your assets to survive a "Red Zone" market crash.

How to Protect Yourself

You cannot control the stock market. You don't know if the first five years of your retirement will be a Bull Market (like the 2010s) or a Bear Market (like the 2000s).

Since you can't predict it, you must protect against it. Here are three strategies:

1. The Cash Bucket (The Volatility Buffer)

This strategy involves keeping 1–3 years of living expenses in safe, liquid cash or cash equivalents.

How it works: If the market crashes, you stop withdrawing from your investment portfolio. Instead, you spend your "Cash Bucket."

The Benefit: This gives your stocks time to recover without you having to sell them at a loss.

2. Guaranteed Income Floors

This is often the most effective defense. By using an annuity to cover your essential expenses, you reduce your reliance on portfolio withdrawals.

How it works: If your bills are paid by Social Security and an annuity, you don't have to sell stocks to eat.

The Benefit: You can leave your market portfolio alone during a downturn, waiting for the rebound, because your lifestyle isn't dependent on the daily stock price.

3. Adjusting Your Withdrawals

This is the "belt-tightening" method. If the market is down, you skip the vacation and eat out less.

The Reality: While good in theory, this is hard to practice. Most retirees don't want to cancel their plans just because the Dow Jones is down.

Frequently Asked Questions

Q: Can't I just wait for the market to come back? A: Not if you need income now. If you have bills to pay, you are forced to sell. That is why Sequence of Returns Risk is so dangerous—it forces you to sell low.

Q: Does diversification fix this? A: Diversification (mixing stocks and bonds) helps, but it doesn't eliminate the risk. In major crashes (like 2008 or 2022), both stocks and bonds can go down at the same time.

Q: When does this risk go away? A: The risk is highest in the early years. Once you have navigated the first 10–15 years of retirement, your portfolio usually has enough growth (or your life expectancy is short enough) that a crash is less likely to wipe you out.

The Bottom Line

Averages are for textbooks. Real life is about timing.

Mr. Lucky and Mr. Unlucky didn't have different investments; they just had different timing. You cannot choose your timing, but you can choose a strategy that takes luck out of the equation.

By building a retirement plan that includes volatility buffers or guaranteed income, you ensure that a bad day in the market doesn't turn into a bad life in retirement.

Is your portfolio ready for a bad sequence?

Don't cross your fingers and hope for a Bull Market. Schedule your Retirement Income Blueprint Masterclass with us at SmartAnnuityHelp.com/book. We will check your exposure to Sequence of Returns Risk and help you build a shield against market volatility.