The Retirement Income Triangle: A Simple Framework for Confident Retirement Planning

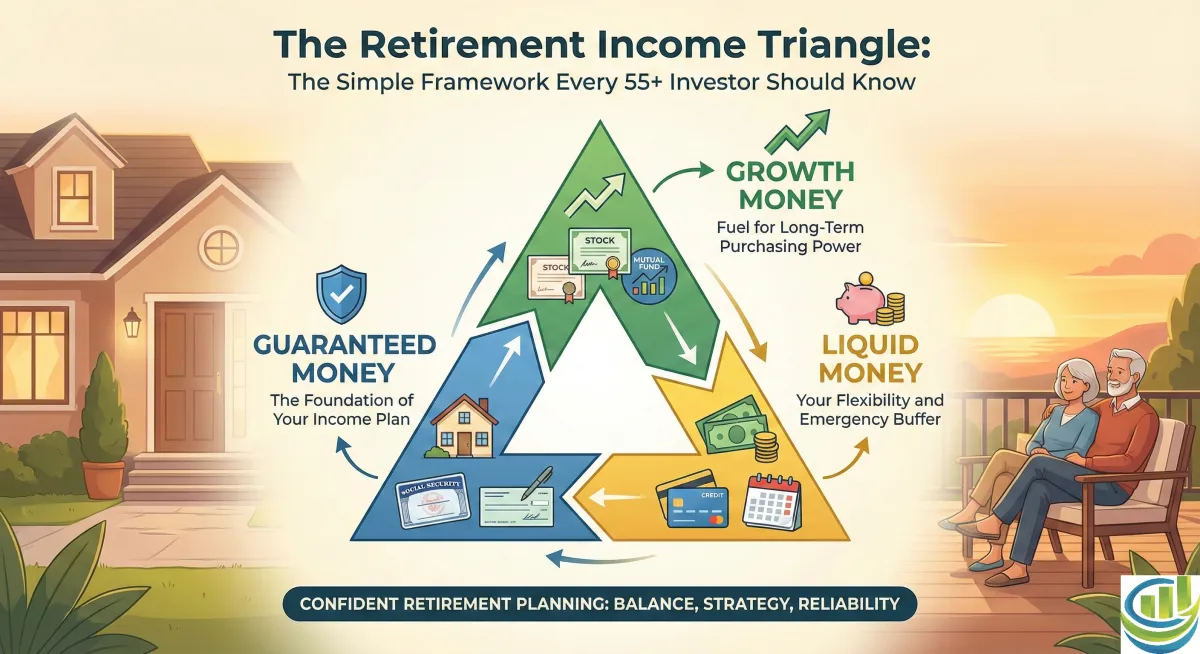

The Retirement Income Triangle: The Simple Framework Every 55+ Investor Should Know

Introduction

Most pre-retirees feel overwhelmed by retirement income planning- and understandably so. The list of decisions is long: Social Security timing, taxes, market risk, long-term care, and how to turn a nest egg into reliable income.

But among the most successful retirees, there’s a common thread: they use a simple, balanced framework to organize their money.

The “Retirement Income Triangle” is that framework. It’s easy to understand, easy to apply, and extremely powerful when used correctly.

The Triangle consists of three categories:

Growth Money

Guaranteed Money

Liquid Money

Managing these correctly can be the difference between a stressful retirement and a confident one.

1. Growth Money: The Fuel for Long-Term Purchasing Power

Growth money helps your retirement income keep up with inflation for 20–30 years. It typically includes:

Stocks

ETFs

Mutual funds

Managed portfolios

The purpose isn’t to swing for the fences-it’s to maintain buying power, so you can afford the same lifestyle 20 years from now.

Why it matters

Over a 30-year retirement, even modest inflation can cut your spending power nearly in half. Growth money helps offset this risk.

Growth mistakes to avoid

Having too much growth money (creates volatility and withdrawal risk)

Having too little (creates long-term inflation risk)

Not coordinating growth money with guaranteed income sources

2. Guaranteed Money: The Foundation of Your Income Plan

Guaranteed money includes income sources that you can count on-no matter what the market does:

Social Security

Pensions

Fixed annuities

Fixed indexed annuities with lifetime income benefits

This bucket covers essential expenses: housing, utilities, food, healthcare, transportation, insurance.

When essential expenses are guaranteed, your entire retirement becomes less stressful-and your growth money gets more time to grow.

Why it matters

The number one fear for retirees? Running out of money. Guaranteed income directly solves that.

3. Liquid Money: Your Flexibility and Emergency Buffer

This is the money you keep accessible for unexpected events or short-term goals:

Cash

Money markets

High-yield savings

Short-term CDs

Liquid money provides:

Emergency protection

Travel and lifestyle flexibility

A buffer during market drops so you can avoid selling investments at a loss

A good rule of thumb for many retirees is 12–24 months of expenses in liquid assets.

How the Three Work Together

When done right:

Guaranteed Money covers essential expenses

Growth Money fuels long-term lifestyle and inflation protection

Liquid Money handles surprises and prevents panic

It’s balance- not guesswork.

It’s strategy- not hope.

Conclusion

The Retirement Income Triangle is simple, practical, and effective- especially for retirees who prefer stability without sacrificing long-term growth.

To schedule a Retirement Income Review to map out your Triangle, click HERE.

To learn more about Ted Foster, click HERE.