Guaranteed Income in Retirement: Why It Matters More Than You Think

Guaranteed Income in Retirement: Why It Matters More Than You Think

By Moritz Loehr

When you are working, you have a very simple financial routine: you go to work, and every two weeks, money shows up in your bank account. You pay your bills, save a little, and live your life. That steady paycheck is the heartbeat of your financial security.

But on the day you retire, that heartbeat stops.

Suddenly, you are staring at a pile of savings—your 401(k), IRA, or brokerage account—and asking yourself the most frightening question in retirement planning: "How do I turn this pile of money into a paycheck that will last as long as I do?"

For decades, the financial industry has focused on "accumulation"—helping you grow that pile. But they often fail to teach you about "decumulation"—how to turn those assets into reliable income.

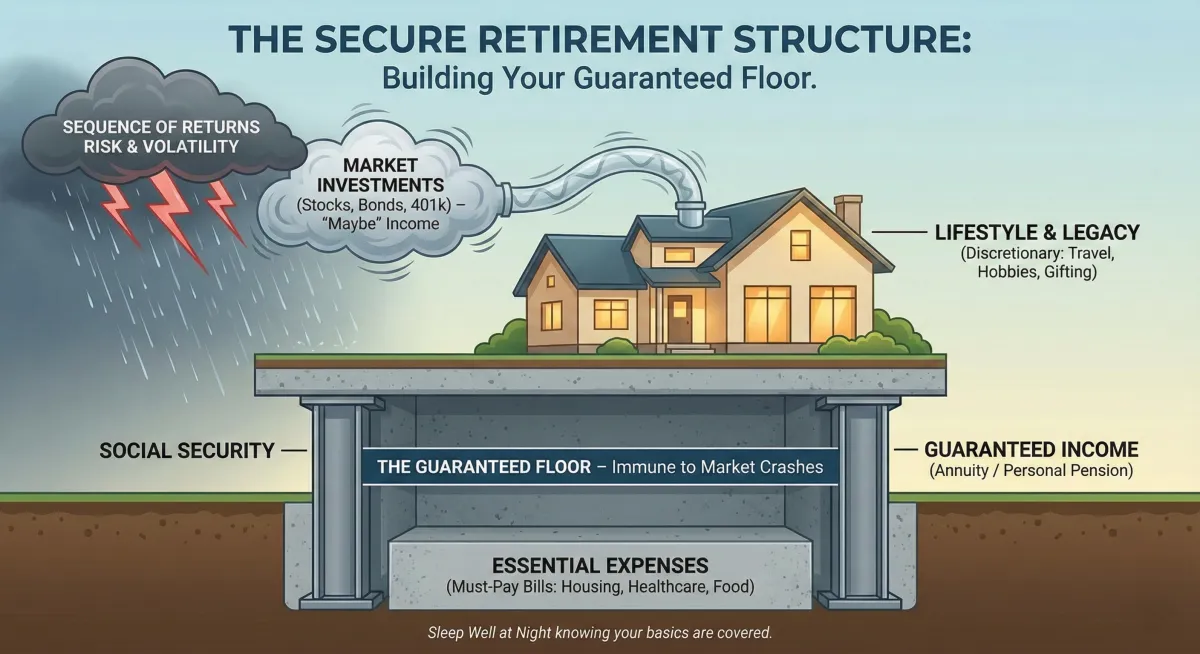

In this guide, we will explore why relying solely on stock market returns can be dangerous for retirees, and why guaranteed income is often the missing piece of a modern retirement plan.

The "Three-Legged Stool" Is Broken

You may have heard of the "three-legged stool" of retirement. In the past, a secure retirement relied on three stable sources of income:

Social Security

Personal Savings

A Company Pension (Defined Benefit Plan)

If you had all three, retirement was fairly simple. Your pension and Social Security covered your bills, and your savings were just "fun money."

Today, that stool is wobbly. According to the Bureau of Labor Statistics, very few private-sector workers have access to a traditional pension anymore. The burden of funding your retirement has shifted entirely from your employer to you.

This leaves most retirees balancing on just two legs: Social Security (which rarely covers all living expenses) and their own investments. If the stock market crashes or you live longer than expected, that two-legged stool can easily topple over.

To fix this, you have to build your own third leg. You have to manufacture your own pension.

Why "Maybe" Income Isn't Enough

Many financial advisors will tell you to keep your money in the market (stocks and bonds) and withdraw 4% each year. They say that historically, the market goes up over time, so you should be fine.

The problem is the word "should."

The stock market offers "maybe" income. Maybe the market will be up this year. Maybe you will earn 8%. But maybe the market will drop 20% right when you need to pay for a new roof or medical bills.

Your bills, however, are not "maybes." The electric company, the tax collector, and the grocery store require "must-pay" money.

The Danger of Sequence of Returns Risk

If you retire into a bear market (a period where stock prices fall), you face a specific danger called Sequence of Returns Risk.

If your portfolio drops by 15% in your first year of retirement, and you still withdraw money to live on, you are digging a hole that your portfolio may never climb out of. You are selling shares at a loss just to pay bills. This depletes your principal much faster than if the market drop had happened later in your life.

Longevity: The Multiplier of Risk

Medical advances mean we are living longer than ever. A healthy couple aged 65 has a 50% chance that at least one of them will live to age 92 or beyond.

If you are planning for a 30-year retirement, relying on variable market returns is a high-stakes gamble. You need a baseline of income that is immune to market corrections and doesn't have an expiration date.

Creating Your Own "Personal Pension"

This is where guaranteed income strategies come in.

Guaranteed income is cash flow that comes to you like a paycheck, regardless of what the S&P 500 does, and continues for as long as you live.

There are generally two ways to build this:

1. Optimizing Social Security

Social Security is the best inflation-adjusted annuity you can buy. Yet, many people claim it as early as age 62 out of fear or impatience, permanently locking in a reduced monthly payment.

For many of our clients, delaying Social Security (if health and savings permit) is a strategic move to maximize that guaranteed base. However, even a maximized Social Security check is rarely enough to maintain a comfortable lifestyle.

2. Annuities: The Gap Filler

The word "annuity" often scares people because it is misunderstood. At its core, an annuity is simply a contract with an insurance company. You transfer a portion of your risk to them, and in exchange, they provide you with guarantees.

While there are many types of annuities, Fixed Index Annuities (FIAs) with income riders are popular tools for retirees who want to protect their principal while generating lifetime income.

Protection: Your principal is protected from market downturns. If the market crashes, you don't lose your initial deposit due to the crash.

Growth Potential: You can earn interest based on the performance of an external index (like the S&P 500), usually up to a certain "cap" or limit.

Lifetime Income: With an income rider, the insurance company guarantees a specific payout rate for life, even if your account balance eventually drops to zero.

Note: Annuities are insurance products, not investments. They have fees, surrender charges, and terms that you must understand. They are designed for long-term security, not short-term trading.

Not sure if you need an annuity or have an annuity you need a checkup on?

Deciding how much of your savings to protect can be tricky. You don’t want to lock up too much, but you don't want to leave yourself exposed to risk.

We can help you find the sweet spot. Schedule your free Retirement Income Blueprint Call with SmartAnnuityHelp.com/book today. We’ll look at your numbers and show you exactly how to create a paycheck you can’t outlive.

The Psychological Benefit: The "Sleep Well at Night" Factor

There is an interesting body of research in retirement psychology. Studies have consistently shown that retirees with higher levels of guaranteed income are happier and less stressed than retirees with equal net worth but no guaranteed income.

Why? Certainty.

When you know that your mortgage, taxes, insurance, and groceries are covered by guaranteed checks (Social Security + Annuity), you don't panic when you watch the financial news.

If the market drops 500 points, it might be annoying, but it won't change your standard of living. This peace of mind allows you to actually enjoy your retirement.

Furthermore, covering your basics with guaranteed income gives you permission to invest the rest of your portfolio more aggressively if you want to. Since you don't need that money for next month's bills, you can let it grow for legacy, long-term care, or inflation protection.

Common Myths About Guaranteed Income

Before you decide if this strategy is right for you, let’s clear up some common misconceptions.

Myth 1: "If I buy an annuity, I lose control of all my money."

Reality: This was true of old-fashioned "immediate annuities" where you handed over a lump sum and it was gone forever. Modern annuities often allow for penalty-free withdrawals (usually 10% per year) and return the remaining account value to your beneficiaries upon death.

Myth 2: "The fees are too high."

Reality: Annuities do have fees, which pay for the guarantees. But you must ask yourself: What is the cost of not having a guarantee? If you pay 1% in fees to avoid a 30% market loss during a crash, that is often a trade-off retirees are happy to make.

Myth 3: "I can do better in the market."

Reality: Over a long period, stocks generally outperform insurance products. But retirement isn't about "beating the market"—it's about solvency. The goal of guaranteed income isn't to get the highest possible return; it's to ensure you never run out of money.

How to Determine Your "Income Gap"

So, do you need guaranteed income? Here is a simple 3-step exercise we do with our clients:

Calculate Your Essential Expenses: Add up the costs you must pay every month (housing, utilities, food, healthcare, taxes).

Subtract Reliable Income: Subtract your monthly Social Security benefit and any pension you might have.

Find the Gap: If your expenses are $6,000/month and your reliable income is $3,500, you have an Income Gap of $2,500.

If you try to fill that $2,500 gap by withdrawing from a volatile stock portfolio, you are taking on significant risk. Our goal at Arize FIG is to help you fill that gap with guaranteed sources so your lifestyle is never in jeopardy.

Let us do the math for you.

Don’t guess about your income gap. Let us help you build a custom plan that stress-tests your portfolio against inflation, taxes, and market crashes.

It’s a online Masterclass, it’s educational, and there’s absolutely no obligation.

SmartAnnuityHelp.com/book

Frequently Asked Questions (FAQ)

Q: Is an annuity the same as a pension? A: Functionally, they are similar. A pension is managed by an employer, while an annuity is a contract you purchase privately from an insurance company. Both are designed to provide a steady stream of income for life.

Q: What happens to the money in an annuity if I pass away early? A: This depends on the specific contract. With many modern Fixed Index Annuities, any remaining account value is passed directly to your named beneficiaries, avoiding probate. You generally do not "lose" the money to the insurance company upon death unless you chose a specific "Life Only" payout option.

Q: Can guaranteed income protect me from inflation? A: Fixed income payments can lose purchasing power over time due to inflation. However, some annuities offer "increasing income" options or inflation riders (usually for a lower starting payout). We often recommend using guaranteed income to cover your "floor" expenses and using other investments to hedge against inflation.

Q: How much of my portfolio should be in guaranteed income? A: There is no one-size-fits-all answer. A common rule of thumb is to cover your essential "must-have" expenses with guaranteed income. Discretionary expenses (travel, hobbies) can be funded by your investment portfolio.

Q: Are these strategies safe? A: Annuities are backed by the financial strength and claims-paying ability of the issuing insurance company. It is vital to choose highly-rated carriers. Additionally, State Guaranty Associations provide a level of protection for policyholders, though limits vary by state.

The Bottom Line

Retirement is not a finish line; it is a new journey that can last 30 years or more. You cannot navigate that journey successfully using "maybe" money for your essential bills.

By building a floor of guaranteed income, you remove the biggest risks from your retirement: market crashes and the risk of outliving your savings.

Don't leave your financial future to chance. Take control of your income, and you’ll take control of your retirement.

Ready to build your Personal Pension?

Stop worrying about the stock market and start planning for a secure future. Schedule your free Retirement Annuity Blueprint Call with us today at SmartAnnuityHelp.com/book, and let’s make sure your money lasts as long as you do.